Smart RoundUps Bright Builder Card Why does Bright need my bank account and credit card information? Is Bright only for credit cards? Which banks and cards are supported? What is the Bright Stash account? How do I delete my Bright account? How does Bright build credit? What is Bright? My card is not available on Bright. What should I do?

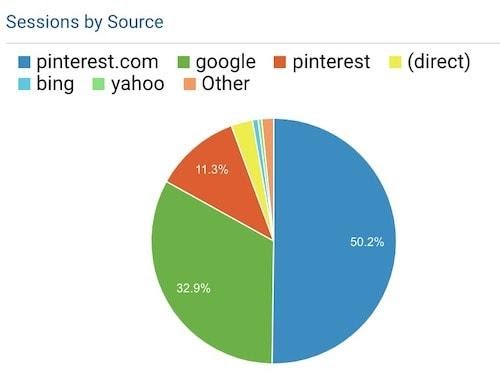

7 tips to drive more traffic from Pinterest to your blog – Supermetrics

Just connect your cards and checking account, set a few goals, and let your Bright Plan get to work. Bright makes smart card payments for you, doing the math for you, even adapting automatically whenever your finances shift. Bright builds more savings faster too, targeted to your personal goals. And you can choose your own debt pay off method

Source Image: help.pinterest.com

Download Image

Oct 5, 2023Oct 5, 2023 2 Bright Money App — pic credit: Bright Money/YouTube Even though the world has largely gone back to a sense of normalcy following the worst of the COVID-19 pandemic, many

Source Image: internationalbanker.com

Download Image

Is your Debt to Income ratio more than 45%? If yes, your credit score might be in trouble. Don’t worry, Bright Money is here to help you… | Instagram Aug 23, 2023Summary. Bright Money was created to help you pay down debt faster, build savings and improve your credit score. The app automatically scans your checking account, adjusts to your spending habits day by day, and then transfers funds to help you meet your financial goals. Set up. 3.75.

Source Image: brightmoney.co

Download Image

Why Is Bright Money Taking Money Out Of My Account

Aug 23, 2023Summary. Bright Money was created to help you pay down debt faster, build savings and improve your credit score. The app automatically scans your checking account, adjusts to your spending habits day by day, and then transfers funds to help you meet your financial goals. Set up. 3.75. 4 days agoYes, Bright Money is a legitimate company. It offers a secure method for achieving your financial goals, including settling credit card debt, improving credit scores, and increasing savings. Backed by over 500 Trustpilot reviews, Bright Money maintains an impressive average rating of 4.5 stars.

Bright Plan: Debt Payoff Made Bright with Bright Money

288 total complaints in the last 3 years. 234 complaints closed in the last 12 months. View customer complaints of Bright Money, BBB helps resolve disputes with the services or products a business Pinterest

Source Image: facebook.com

Download Image

Always here to help. 288 total complaints in the last 3 years. 234 complaints closed in the last 12 months. View customer complaints of Bright Money, BBB helps resolve disputes with the services or products a business

.png)

Source Image: brightmoney.co

Download Image

7 tips to drive more traffic from Pinterest to your blog – Supermetrics Smart RoundUps Bright Builder Card Why does Bright need my bank account and credit card information? Is Bright only for credit cards? Which banks and cards are supported? What is the Bright Stash account? How do I delete my Bright account? How does Bright build credit? What is Bright? My card is not available on Bright. What should I do?

Source Image: supermetrics.com

Download Image

Is your Debt to Income ratio more than 45%? If yes, your credit score might be in trouble. Don’t worry, Bright Money is here to help you… | Instagram Oct 5, 2023Oct 5, 2023 2 Bright Money App — pic credit: Bright Money/YouTube Even though the world has largely gone back to a sense of normalcy following the worst of the COVID-19 pandemic, many

Source Image: instagram.com

Download Image

Honest Bright Money Review: Is Bright Money Legit? [2023] Jan 16, 2024Bright’s MoneyScience™ AI makes payments for you, slashing interest costs, avoiding late fees, and even adapting to your shifting finances. 6. Use Bright. Bright can get anyone debt-free faster, so you stop losing money on your banks’ fees and charges. But Bright can also build your savings faster. Week by week, Bright moves funds from

![Honest Bright Money Review: Is Bright Money Legit? [2023]](https://mamainvesting.com/wp-content/uploads/2022/08/2-2.webp)

Source Image: mamainvesting.com

Download Image

Money: “Good morning, Devi. Please spend freely as you wish today. There’s plenty of money available to you always,… | Mobile banking, Banking app, Personal savings Aug 23, 2023Summary. Bright Money was created to help you pay down debt faster, build savings and improve your credit score. The app automatically scans your checking account, adjusts to your spending habits day by day, and then transfers funds to help you meet your financial goals. Set up. 3.75.

Source Image: pinterest.com

Download Image

Pinterest 4 days agoYes, Bright Money is a legitimate company. It offers a secure method for achieving your financial goals, including settling credit card debt, improving credit scores, and increasing savings. Backed by over 500 Trustpilot reviews, Bright Money maintains an impressive average rating of 4.5 stars.

Source Image: facebook.com

Download Image

Always here to help.

Pinterest Just connect your cards and checking account, set a few goals, and let your Bright Plan get to work. Bright makes smart card payments for you, doing the math for you, even adapting automatically whenever your finances shift. Bright builds more savings faster too, targeted to your personal goals. And you can choose your own debt pay off method

Is your Debt to Income ratio more than 45%? If yes, your credit score might be in trouble. Don’t worry, Bright Money is here to help you… | Instagram Money: “Good morning, Devi. Please spend freely as you wish today. There’s plenty of money available to you always,… | Mobile banking, Banking app, Personal savings Jan 16, 2024Bright’s MoneyScience™ AI makes payments for you, slashing interest costs, avoiding late fees, and even adapting to your shifting finances. 6. Use Bright. Bright can get anyone debt-free faster, so you stop losing money on your banks’ fees and charges. But Bright can also build your savings faster. Week by week, Bright moves funds from